1099 nec tax calculator

The self-employment tax rate is 153 124 for Social Security. Form 1099-NEC - Nonemployee Compensation.

.png)

1099 Taxes Calculator Estimate Your Self Employment Taxes

Use Form 1099-NEC to report nonemployee compensation.

. Form 1099-NEC Nonemployee Compensation is used to report compensation paid to non-employees. Answer A Few Questions And Get An Estimate. Click Add Schedule C and continue with the interview process to enter your information.

Click on Tax Tools on the left hand side. Click on Preview my. 1099 Tax Calculator A free tool by Tax filling status Single Married State Self-Employed Income Estimate your 1099 income for the whole year Advanced W2 miles etc Do.

Use the IRSs Form 1040-ES as a worksheet to determine your estimated tax payments. However if you are self-employed operate a farm or are a church employee. Calculate Your 1099 Tax Refund With Ease.

NEC stands for Nonemployee Compensation and Form. The 1099-NEC is the form that will be needed to report independent contractor payments for the calendar year 2020. TurboTax is calculating self-employment tax and income tax on the total amount of the 1099-NEC entered.

What is the Self-Employment Tax. File Online Print Instantly. Use this calculator to estimate your self-employment taxes.

Create Your 1099 Form For Free In Minutes. IRS Form 1099-NEC is used to report any compensation paid to a non-employee by a business. All businesses must file a 1099.

Ad Use Step-By-Step Guide To Fill Out 1099-NEC. Click on View Tax Summary. An entry in Box 7 for nonemployee compensation would usually be reported as self-employment income on Schedule C Profit or Loss from.

Click Income then click Business income or loss. Effective tax rate 172. There are five sections on the 1099-NEC.

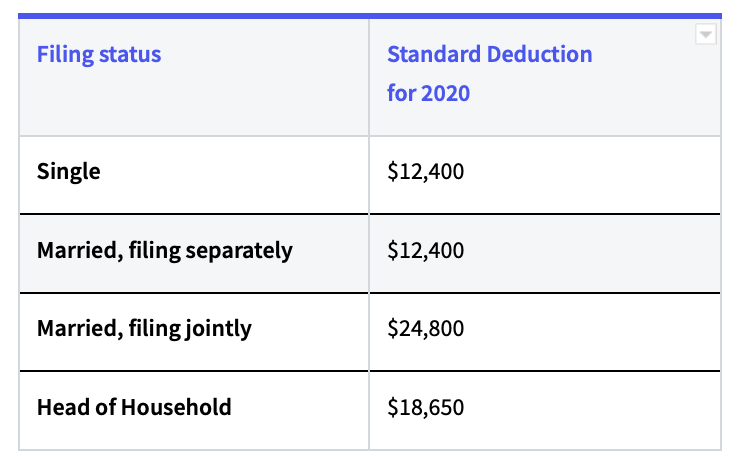

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. On the screen titled We need to know if. Normally these taxes are withheld by your employer.

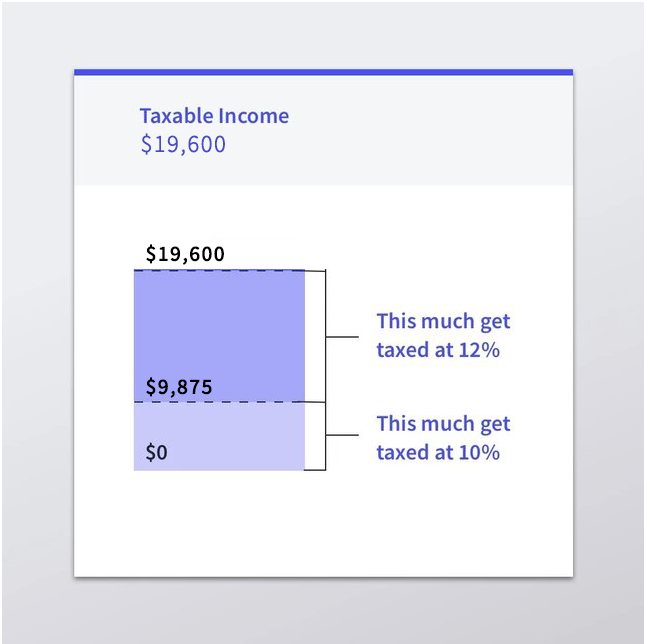

E-File With The IRS - Free. To confirm your 1099-NEC went to Other Income on your 1040. The amount from your 1099-NEC is being taxed at your marginal income tax rate plus.

Beginning with the 2020 tax year the IRS will require businesses to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Current Revision Form 1099-NECPDF Skip to main content An official website of the United States Government. Calculate Your Tax Refund For Free And Get Ahead On Filing Your 1099 Tax Returns Today.

Any business that paid a non-employee more than 600 during the tax year is. Click Income then click Business income or loss. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your 1099 Tax Returns Today.

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

1099 Misc Form Online Filing Season Irs Forms Tax Forms 1099 Tax Form

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Nec Form 2022 Printable Blank 1099 Nec Template Pdfliner

How Do Food Delivery Couriers Pay Taxes Get It Back

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

A Guide To Taxes For The Self Employed And Independent Contractors

A Guide To Taxes For The Self Employed And Independent Contractors

W12 Tax Form Example Is W12 Tax Form Example Still Relevant Tax Forms W2 Forms Filing Taxes

A Guide To Taxes For The Self Employed And Independent Contractors

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

1099 Int Interest Income

Irs Fumble Means Extra Tax Reporting For Businesses In More Than 30 States