Equation for sales tax

The LA County Board of Supervisors on Tuesday Aug. CARE FOR YOUR WATCH YOUR ACCESSORIES USER MANUAL SERVICES CARE PROGRAM.

Income Statement Formula Calculate Income Statement Excel Template

Issues that cant be solved using old formulas but instead require new thinking.

. While many factors influence business location and investment decisions sales taxes are something within policymakers control that can have immediate impacts. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the. New ways of working.

The exemption figure covers both the lifetime gift tax exemption and the estate tax exclusion. Sales refer to the operating revenue you generate from business activities. We also assume the sales and marketing costs for PVBESS includes the cost of 20 more hours for a DC-coupled system and 32 more hours for an AC-coupled system than would be included for a PV-only system installation Feldman et al 2021 Table 10.

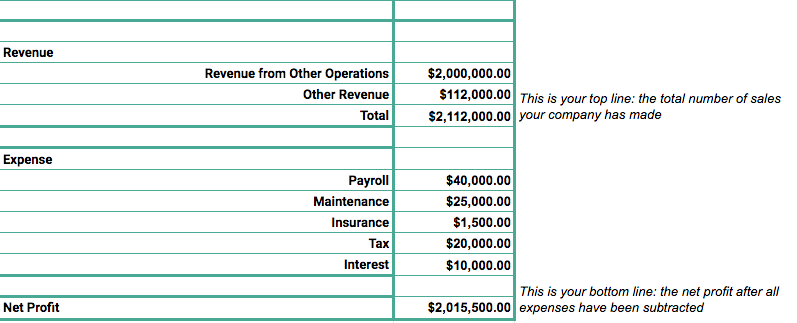

Submersible QuarantaQuattro Luna Rossa. This section shows the gross sales that a company makes in a given period. Net Annual Credit Sales Beginning Accounts Receivable Ending Accounts Receivable 2 For example a company wants to determine the companys accounts receivable turnover for the past year.

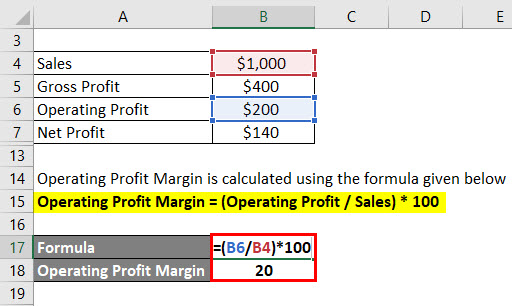

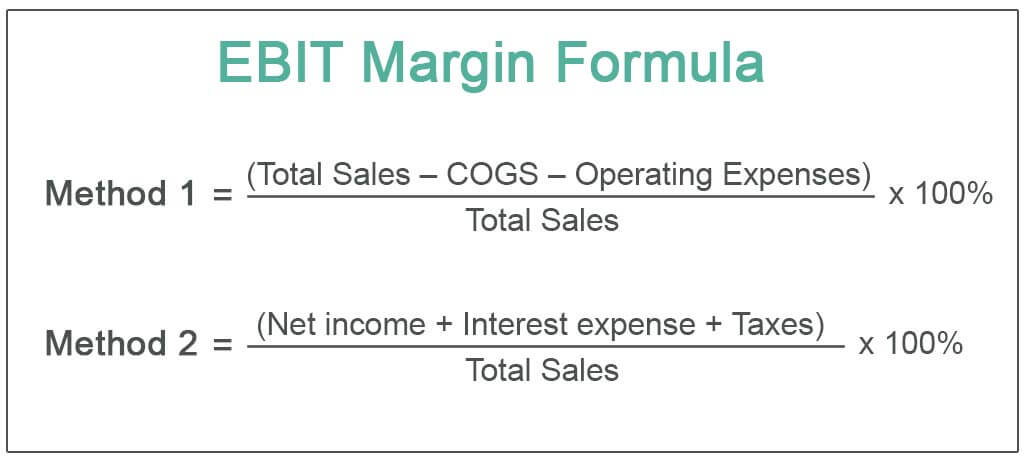

Profit margin net income sales. The world is changing faster than ever bringing unimagined new challenges. For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0.

The Other Half. California has the highest state-level sales tax rate at 725 percent. 255 divided by 106 6 sales tax 24057 rounded up 1443 tax amount to report.

Net income is the total amount of money your business has made after removing expenses. In the Default Value box insert x 0065. Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia.

Calculating a discount is one of the most useful math skills you can learn. In the beginning of this period the beginning accounts receivable balance was 316000 and the ending balance was 384000. It indicates the organizations overall profitability after incurring its interest and tax expenses.

Gross Profit Margin 39 2 Net Profit Margin. Equation of Time Regatta INNOVATION MOVEMENTS CUSTOMER SERVICE. When the t and τ rates are chosen respecting this equation where t is the rate of income tax and tau is the consumption taxs rate.

As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt. For example gross sales dont account for costs associated with item production employee wages building rent returns theft or sales tax. New solutions for a new day.

When you divide your net income by your sales youll get your organizations profit margin. For instance most. Delivering tax services insights and guidance on US tax policy tax reform legislation registration and tax law.

Sales tax rates arent the only factor that matters. What this accounting equation includes. Compare 2022 sales taxes including 2022 state and local sales tax rates.

For example if the sales tax rate is 6 divide the total amount of receipts by 106. Where x is the Subtotal field ID and 0065 is equivalent to 65 sales tax. Add a number field.

Submersible QuarantaQuattro Bianco PAM01226 incl. 9 2022 passed a resolution that creates a ballot measure asking voters to consider a cannabis tax on the Nov. Set up the calculation to use 2 decimal places.

The New Equation is about looking at the world from new angles. The tax basewhat is and isnt taxablecan have a significant impact on the competitiveness of different sales tax regimes and the efficiency with which they raise revenue. Gross sales Sum of all sales Total units sold Sales price per unit.

Calculate sales tax. Gross Profit Margin Gross Profit Sales. Every income statement has sales or revenue as its first section.

Net Profit Margin Net Profit Margin Net profit margin is the percentage of net income a company derives from its net sales. Sales or revenue on the income statement falls under two classifications. For a VAT and sales tax of identical rates the total tax paid is the same but it is paid at differing points in the process.

To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. You can apply it to tips at a restaurant sales in stores and setting rates for your own services. To calculate gross sales determine the total sales before deductions ie sales or returns.

For the PV systems shown in Figure 36 this adds 2030 to customer acquisition costs. In 2022 the exemption sits at 1206 million dollars. The 1012 Tax Bracket.

State sales tax bases can vary greatly. Read more is a ratio of net profit to sales. However it is important to bear in mind that any element of the exemption that you use to avoid paying tax on gifts will decrease the exemption you have available for estate tax.

If you need to add sales tax to a total amount follow the instructions below. Beauty CEO Tarang Amin joins Yahoo Finance Live to discuss Q1 earnings the businesss cosmetics and skincare segments and consumer behavior amid inflation. In the field options set up a field calculation.

What is The New Equation. Revenue or sales refers to what the company makes from sales and other services rendered to its customers. The basic way to calculate a discount is to multiply the original price by the decimal form of the percentage.

The Other Half of the Equation.

Sales Revenue Formula Calculate Grow Total Revenue

Tip Sales Tax Calculator Discount Calculator Calculator Sales Tax

How To Calculate Sales Tax In Excel

Sales Tax Calculator

How To Calculate Sales Tax In Excel

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Ex Find The Sale Tax Percentage Youtube

Profit Before Tax Formula Examples How To Calculate Pbt

How To Calculate Sales Tax In Excel Tutorial Youtube

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax Definition Formula Example

Ebit Margin Formula Excel Examples How To Calculate Ebit Margin

Sales Tax Calculator

How To Figure Out And Calculate Sales Tax Math Wonderhowto

How Do You Figure Out Sales Tax Virtual Nerd

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price